Optimizing cash management contributes to positive cash flow, effective working capital, and robust financial health. By optimizing their cash flow, businesses can accurately forecast their cash inflows and outflows, maintain sufficient cash for purchases, plan intelligently for capital expenditures, and take advantage of business and investing opportunities.

In this latest post, you will learn how to plan, implement, and monitor the outcomes of a successful and sustainable cash management process.

Key Takeaways

- 10 performance-breaking benefits of optimized cash management

- 5 benchmarks that can transform your cash flow visibility

- 12 tactics to help weather a cash shortage

- 5 reasons why cash flow is more important than profit

- 17 cash management best practices

Understanding cash management

What is cash management?

Cash management involves managing revenues and expenditures that flow into and out of a company. It’s how a business manages its financial operations — including accounts receivable, accounts payable, and short-term investments — while ensuring sufficient cash is available for future use. Effective cash management improves a company’s profitability by shortening the collection timeline (thus improving cash flow), reducing operational costs, and slowing cash disbursements.

5 business functions optimized through effective cash management

- Inventory control

- Accounts receivable

- Accounts payable

- Financial investments

- Financing activities

- Management of cash flow risks

5 key goals of cash management

- Maximize liquidity

- Minimize the cost of funds

- Meet short-term financial obligations

- Plan for unforeseen expenses

- Invest in growth opportunities

The importance of the cash flow statement in cash management

The cash flow statement is a core component of cash flow management. The cash flow statement comprehensively documents all of a business’s cash flows. It includes:

- Cash movements from operating activities

- Cash movements from investing activities

- Cash movements from financing activities

The bottom line: the cash flow statement reports a company’s current cash position and movements over a period of time.

An effective cash management program optimizes all aspects of the business

Why cash management matters

The success of any business depends on it generating enough cash from its activities to meet current financial obligations, repay investors, grow the business, and plan for the future. A business has more control over its activities when it can meet everyday expenses without taking on debt. Effective cash management offers a complete picture of costs versus revenue, providing a true understanding of the business’s financial health.

Without effective cash management, a business can collapse quite quickly because it lacks available cash for regular or unforeseen expenses. Many small businesses struggle with cash management and positive cash flow because they are dependent on sales and timely payments.

According to research conducted by U.S. Bank and cited on the SCORE/Counselors to America’s Small Business, the primary reasons for small businesses failure include poor cash flow management and a poor understanding of cash flow.

Here are additional statistics that highlight the preponderance of cash flow issues among small businesses:

- According to a survey by the Federal Reserve Bank, 63% of small businesses reported experiencing cash flow problems in 2019.

- In a study by Intuit QuickBooks, 61% of small business owners said they struggle with cash flow management.

- A report by JPMorgan Chase found that the median small business has only 27 days’ worth of cash reserves on hand.

What optimized cash management enables a business to do

- Achieve optimal cash flow

- Maintain cash on hand for purchases and other purposes

- Plan intelligently for capital expenditures

- Negotiate financing with better terms

- Take advantage of business and investing opportunities

- Estimate the cash profits and not just profits from outstanding receivables

- Detect cash embezzlement and shrinkage

- Accelerate the working capital cycle

- Support rewarding customers that make quicker payments

- Speed up decision making

5 reasons why cash flow is more important than profit

- Cash flow can better determine the financial health of a business.

- Cash flow can identify operational problems that profit can’t show.

- Positive cash flow that is invested to expand the business can lead to greater profits in the long term.

- Cash flow is available cash that can be used to pay off debts quickly.

- Steady positive cash flow helps in predicting the growth of a business.

Why cash flow is more important than profit for a small business startup

Growth often requires a significant amount of cash. Purchasing inventory, renting office space, hiring employees, and acquiring technology all occur before any sales are made and revenue starts coming in. If you need more funds to match your growth, you will have problems. Managing your cash flow effectively can help you decide when to make these investments.

Total cash flow visibility

Cash flow visibility is crucial for businesses to understand their financial situation. Quite simply, you can’t effectively manage cash flow if you can’t see what’s happening with your money.

Total cash visibility means having accurate information on the amount of money you have within the company. At any given time you understand your cash flow, you know exactly where your funds are and how much you have available. This includes the source of cash inflows and what the cash outflows are per account or subsidiary.

Why does total cash flow visibility matter?

Cash flow visibility enables a company to invest cash strategically while minimizing debt, expenses, and risk exposure. Accurate visibility can also contribute to organizational growth and greater operation efficiency.

When you have complete cash flow visibility:

- You know where and how the money is being spent

- You’re more likely to make the most of the capital you have

- You have the complete picture to make an accurate forecast

- You can make better, more informed decisions and plan effectively

- You’re less reliant on external funding

Improve your cash flow visibility by monitoring these 5 benchmarks

Operating Cash Flow (OCF)

Operating cash flow is a measure of the amount of cash generated by a company’s normal business operations.

Why is OCF important?

Operating cash flow tells investors whether a company has enough cash flow to pay its bills; otherwise, it may require external financing for capital expansion. OCF helps businesses expand, launch new products, pay dividends, and reduce debt. Without positive cash flow a company’s options are severely limited.

Tactics to improve operating cash flow include:

- Collecting overdue receivables

- Increasing inventory turnover

- Paying suppliers per agreed terms

- Raising prices

How to calculate operating cash flow

Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital

Tactics to improve operating cash flow include:

- Leasing instead of buying for short-term cash relief

- Offering discounts for early payment to encourage faster payments

- Conducting customer credit checks

- Improving inventory management to prevent shrinkage and over-spending

- Invoicing customers immediately followed with reminder emails to improve collection efforts

- Using electronic payments to receive cash faster

- Negotiating with suppliers for more favorable payment terms so the business can hold on to funds longer, improving cash flow

- Raising prices with improved services and features

Net Change in Cash

Net change in cash reflects how much the value of cash and cash equivalents changed during the reporting period. It is the primary indicator on the cash flow statement. For new and growing companies making significant investments for their future, understanding the net change in cash is crucial since it helps determine the available liquidity and the ability to continue making new investments.

Free Cash Flow (FCF)

Free cash flow (FCF) is the money a company has left from revenue after paying all its financial obligations — operating expenses and capital expenditures — during a specific period. FCF reflects cash that can be safely invested or distributed to shareholders.

Why is free cash flow important?

Investors and business analysts find FCF vital because it shows how much cash the company has at its disposal. FCF is often used to evaluate whether a company has enough cash to repay debts, issue dividends, and buy back shares. FCF also measures a business’s growth and success. Because FCF accounts for changes in working capital, it can provide important insights into the value of a company and the health of its fundamental trends.

Discounted Cash Flow (DCF)

DCF estimates the current value of an investment by taking into account its future cash flows.

Why is DCF important?

Discounted cash flow helps investors evaluate how much money goes into the investment, the timing of when that money is spent, how much money the investment generates, and when the investor can access the funds from the investment.

How to calculate discounted cash flow

- Forecast the expected cash flows from the investment.

- Select a discount rate, typically based on the cost of financing the investment or the opportunity cost presented by alternative investments.

- Discount the forecasted cash flows back to the present day.

DCF Formula =CFt /( 1 +r)t

Where,

- CFt = cash flow in period t.

- R = Appropriate discount rate that has given the riskiness of the cash flows.

- t = the life of the asset, which is valued.

Free Cash Flow-to-Sales Ratio

Free cash flow-to-sales is a performance ratio that looks into a company’s operating cash flows after subtracting all sales-relative capital expenditures. The free cash flow to sales ratio is calculated by dividing the company’s free cash flow by its sales revenue. This figure is expressed as a percentage.

FCF to Sales = Free Cash Flow / Sales Revenue

A FCF ratio of less than 1% indicates that the company is not generating enough cash flow from its sales to cover its expenses. A ratio greater than 1% means that the company has more cash available than it spends on capital expenditures.

What is the difference between cash management and cash flow?

Cash management involves the strategies, systems, and tactics used by a company to ensure that its cash flow is sufficient to cover its financial obligations. Cash flow refers to the net change resulting over time from inflows and outflows of cash. It indicates whether a business can meet its existing financial obligations as well as plan for the future.

How to build a cash management plan

A cash management plan needn’t be complex, but it must oversee two core activities: cash coming in and cash going out.

Cash flowing into the business includes:

- Sales receipts

- Cash handling

- Credit transactions

- Invoicing and accounts receivable

- Interest income

Cash flowing out of the business includes:

- Purchasing

- Accounts payable

- Inventory management

- Payroll

The quickest way to develop an effective and executable cash management plan is to audit your current systems. Determine and prioritize the systems with the most significant and fastest impact on your cash flow. This will help form your map for making improvements.

Identifying the strengths and weaknesses of your processes, establishing company priorities and goals, defining what’s required to move it forward, and listing actionable steps to achieve change are all vital to creating an effective plan.

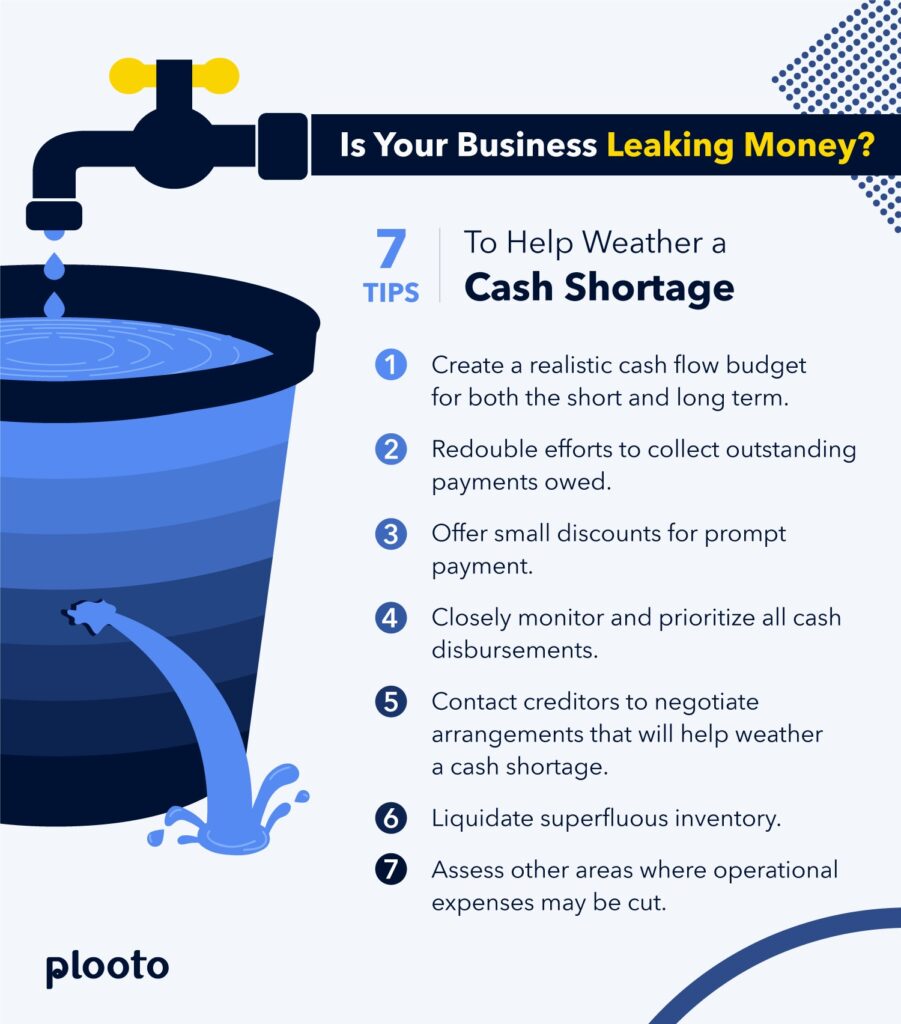

12 tactics to help weather a cash shortage

- Create a data-driven cash flow budget for both the short and long term

- Make collections an extreme priority

- Offer discounts and other incentives for prompt payment

- Closely track and prioritize all cash disbursements

- Contact creditors to negotiate arrangements that will help weather a cash shortage

- Liquidate superfluous inventory

- Assess other areas where operational expenses may be cut

- Keep a weekly cash management forecast to stay on top of the situation. Your cash forecast should:

- Identify cash inflows and outflows

- Categorize and prioritize expenses — invoices that require immediate payment versus expenses that can be deferred

- Seek input across all teams, not just finance and accounting

- Ask key stakeholders, vendors, and business partners for help

- Explore finance options

- Sell non-essential assets

- Consider price increases and “fire” sales

17 Cash management best practices

- Streamline and automate workflows

- Improve cash culture (where everyone in the company understands not only how their actions affect cashflow, but how they can improve it as well)

- Use analytics to drive both operations and business strategies

- Improve asset and inventory management

- Lease, don’t buy, to avoid large outlays of cash to improve cash flow

- Offer discounts for early payment

- Conduct customer credit checks

- Improve inventory management so excessive cash isn’t tied up in stock

- Invoice customers immediately

- Use electronic payments for speed and efficiency

- Negotiate better terms with your suppliers

- Increase pricing based on market demands

- Create a cash flow statement and analyze it monthly

- Create a history of your cash flow to identify seasonal low-cash months

- Forecast your cash flow needs over the next 12 to 24 months

- Manage your growth — exercise caution when expanding into new markets, developing new product lines, hiring employees, or introducing new marketing efforts

- Regularly assess the accuracy and effectiveness of your cash management process

How payment automation improves cash management

Payment automation:

- Streamlines the entire payments process

- Reduces processing and customer support costs

- Helps you time payments to optimize cash flow

- Enables greater control and insight into the payment process

- Dramatically speeds up invoice processing

- Makes it easier and faster for customers to pay you by supporting multiple payment options

- Prevents costly, time-consuming errors such as duplicate payments

- Increases overall cash flow visibility and control

- Reduces check, ACH fraud

Plooto’s impact on cash flow management and cash flow visibility

Plooto simplifies and automates cash flow management through a single integrated AP/AR platform. This platform lets you easily view, track, and manage the entire cash flow cycle.

Digitally collect and collate all the data you need just once

Plooto automates the manual processes associated with inputting a bill. You can upload your invoices into Plooto using Plooto Capture — AI-powered optical character recognition technology. Plooto Capture seamlessly extracts and collates all the information on the invoice to publish from Plooto into your accounting software, recording it as a bill to be paid. Plooto then automatically pulls the data from your accounting software, allowing you to make payments against the newly created bills, all without ever leaving the Plooto application.

With Plooto Capture, you can collect and compile all the data you need in one place digitally. This eliminates the need for manually creating a bill. You also skip the extra step of logging into your accounting software to verify that the bill information is correct. Plooto dramatically reduces errors caused by inefficient, error-prone manual processes.

Identify outstanding transactions, pay bills, and confirm payment in a few clicks

Plooto automatically recognizes any outstanding transactions that require payment or receipt. It allows you to schedule direct bank-to-bank money transfers, including foreign exchange and cross-border payments. The money is electronically pulled from your bank account and deposited into your vendor’s account, with payment status tracking throughout the process, and confirmation once the payment is complete.

In addition, a dashboard enables you to identify and review your pending payables, payments in progress, and completed payables and receivables, providing you with complete cash flow visibility.

Plooto handles multiple payment types, including check payments, E-transfers, ACH, and EFT payments. Plooto Instant is among the fastest methods to pay vendors.

Ensure cash flow continuity while getting paid faster

Plooto supports multiple payment collection options, including credit card, recurring payments, and pre-authorized debit (PAD) payments. Recurring payments and PADs accelerate payment collection, ensure cash flow continuity, and increase visibility into cash flow forecasting.

Having visibility of cash inflows and outflows on a single platform simplifies cash flow management.

In addition, electronically sent payment requests save you the effort and time spent sending invoices by email or postal mail. It also eliminates the need to collect payments through third-party vendors or banks that do not reconcile with your accounting software.

Make better decisions through accurate data and greater visibility

Seamless and robust data integration between Plooto and your accounting software ensures accurate recording of information, correct payments, and a more manageable and faster end-of-month reconciliation. Plooto automatically provides payment and approval trails and records the information needed for reconciliation. In addition, the raw data can be filtered and used for various reporting purposes, such as reviewing specific suppliers. For deeper analysis and reporting, you can easily export this data into an Excel/ csv file, which can then be imported into third-party data tools for study.

Plooto provides the data — and visibility — you need to make better cash flow and business management decisions.

Peter Drucker famously said, “The best way to predict the future is to create it.” A company that optimizes its cash management is creating the foundation for success. The better a company can handle its revenues and expenditures, financial operations, and working capital the more likely it will thrive in a business climate of daily disruptions and unexpected downturns.

What is cash management?

Cash management involves managing cash inflows and outflows. Business cash management involves maximizing cash flow, maintaining a cash reserve, managing business lines of credit, and improving operational efficiency.

What is an example of cash management?

Improving the accounts payable process is one example. You have a positive and long-term relationship with a vendor. Currently, the vendor ships supplies to your business every month and requires payment every 30 days. Because you have a good relationship, you’re able to negotiate payment for invoices every 45 days, which improves your cash flow.

How do I practice good cash management?

Best practice activities include monitoring your cash flow closely; making regular cash projections; invoicing customers quickly with follow-up reminders; streamlining and automating processes.